Font Resize:-+

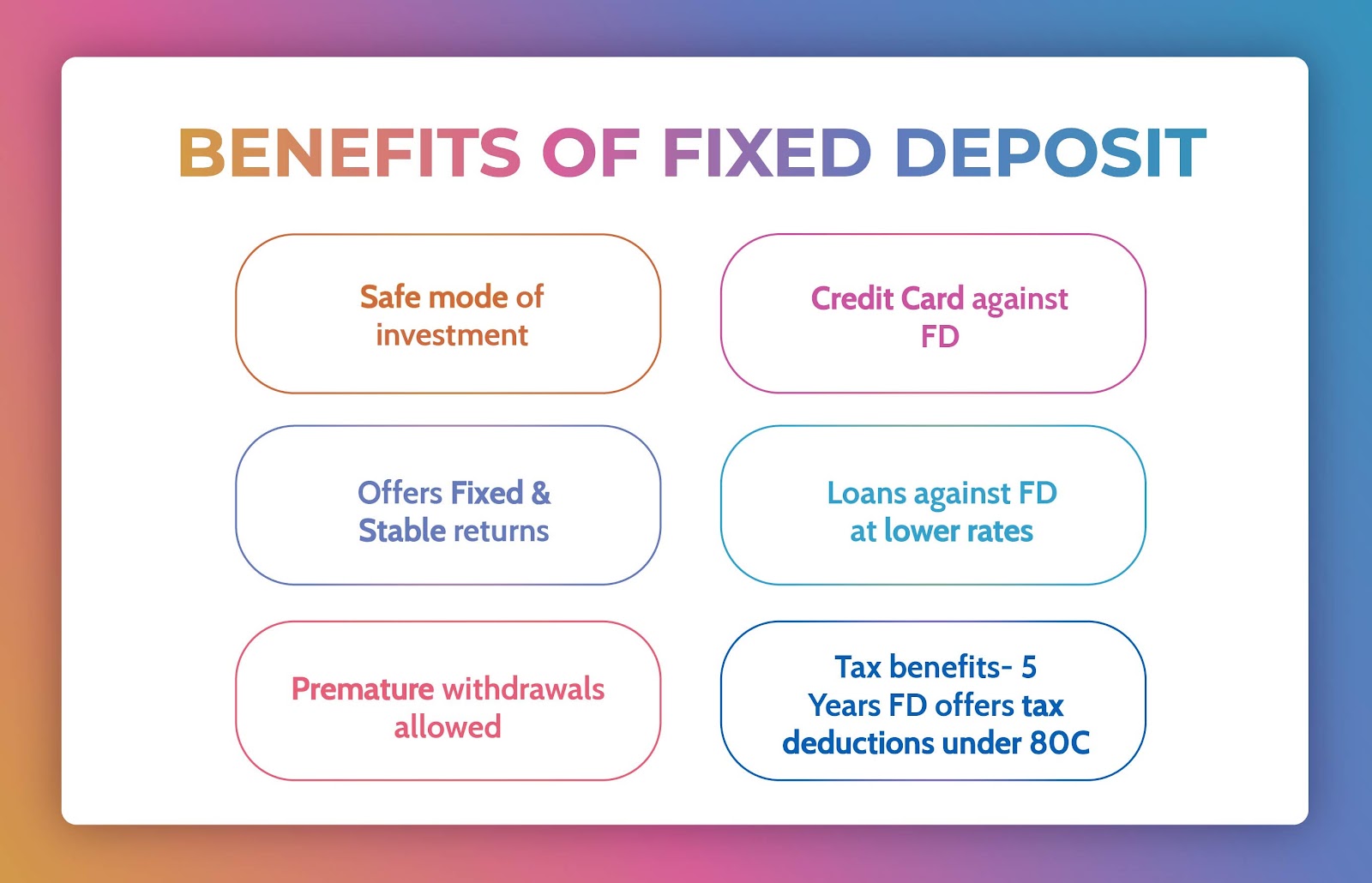

Considered a safe haven compared to other investment types, a Fixed Deposit (FD) is a popular choice for many first-time investors. It guarantees a high return, easy to manage, rewards loyalty, and is protected by government insurance. Fixed Deposit (or FD) is a low-risk financial instrument that is offered by banks, post offices or Non-Banking Financial Companies (NBFCs). You can easily invest in a Fixed Deposit and grow your savings at a fixed rate of interest, which is higher than interest rates offered by savings accounts.

| | | St. Vincent and the Grenadines |

|

| |

|

Fixed Deposit Interest Rates

Fixed Deposit Account

Enjoy competitive interest rates for your money invested for fixed periods! With a First Citizens Fixed Deposit Account you can be assured that your money grows safely and soundly. It means security for you and your family through medium to long- term savings. Invest wisely today by opening a First Citizens Fixed Deposit Account. TTD Fixed Deposits- Terms of 3, 6, 12, 18, 24 and 36 months

- Minimum opening deposit $1,000

- Interest Rate Structure Interest rate is paid based on the band of savings as well as the term of the deposit. The deposit bands are as follows:

- $1,000 - $19,999

- $20,000 - $99,999

- $100,000 - $249,999

- $250,000 - $499,999

- $500,000 - $999,999

- Over $1,000,000

USD Fixed Deposits- Terms of 30 days, 3, 6 & 12 months

- Minimum opening deposit of $1,000.00

- Interest Rate Structure Interest rate is paid based on the band of savings as well as the term of the deposit. The deposit bands are as follows:

• $1,000 - $74,999

• $75,000 - $149,999

• $150,000 - $999,999

• Over $1,000,000

Additional Benefits- Your funds can act as excellent security for a loan you may need

- You have the ease of automatic renewal of your contract at the end of the period

- Our free Telebanking Service allows you to perform banking transactions from a touch tone telephone. It saves you valuable time

- You can also sign up for our free Internet Banking Service to conduct banking transactions from anywhere and at anytime.

- Our free Mobile Banking Service allows you to access your accounts from a mobile device. You can access account balances, account history, Transfer funds and account alerts all from your mobile phone.

Please note: The Policy of the Bank concerning the payment of interest on Fixed Deposits broken before maturity is as follows: - Less than 3 months - $20 plus no interest

- More than 3 months - Savings rate, number of days

- Interest rates and terms of default are subject to change and customers will be advised accordingly

Insured by the DIC Corporation of Trinidad and Tobago. (Up to $125,000)

|

Comments are closed.