![]()

Competitive, guaranteed interest rates A TD Choice Promotional CD may be a good choice if you want a fixed return and don't need access to your money for the duration of the term A wide variety of terms Choose the term that fits your savings goal – check out our featured 12-month and 5-year CDs.

Td Bank Cd Rates Massachusetts

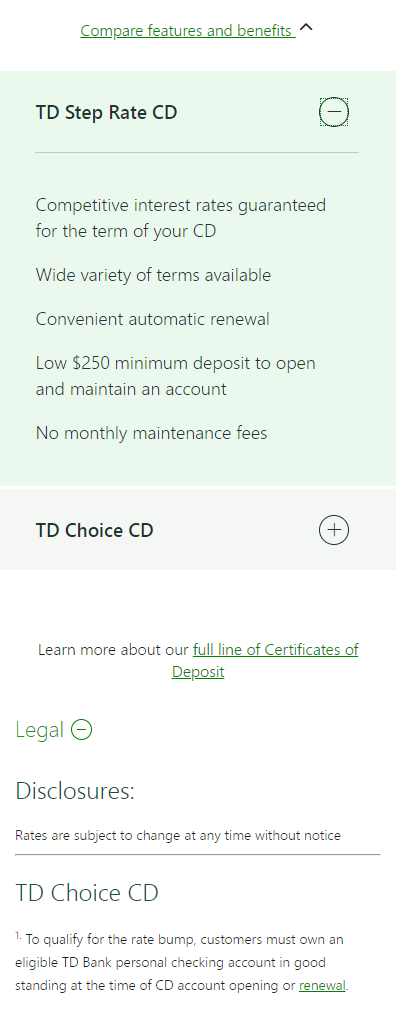

- TD Bank CD TDs rate terms are from 3 months to 5 years. It offers a variety of deposit products which include standard deposits, deposits with a bump for holding a checking account, nocatch cds which allows a withdrawal per term and step rate CDs.

- Visit now to learn about TD Bank no fee CDs and find interest rate info, 6 months to 5 year terms, withdrawals & low $250 minimums. Find the right CD for you!

- TD Bank 3 Month CD Rates: 0.25%: 7 Year Interest Rate was b - USD - Aug, 2019: More Info: First National Bank Alaska 3 Month CD Rates: 0.21%: The rates are applicable to deposits that have an opening balance of more than $100,000. USD - Aug, 2019: More Info: Zions Bank 3 Month CD Rates: 0.20% - USD - Aug, 2019: More Info: Edward Jones 3.

- Best CD rates of March 2021. Bankrate has conducted market research on over 4,000 banks and credit unions nationwide to find accounts with the best CD rates. Here is Bankrate's list of top banks.

Td Bank Cd Rates 6 Months

Not sure which certificate of deposit account is right for you? Read more about the benefits and features of each to help you decide.

You might also be interested in: |

Comments are closed.